Welcome to the June edition of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends and what consumers value. This month, we look at overall shopper concern, what categories consumers are actually cutting back in, inflations impact on health and beauty care products, summer holidays and how consumers plan to enjoy ice cream this summer.

Shopper concern is becoming more severe when it comes to inflation, COVID, finances, and supply chain.

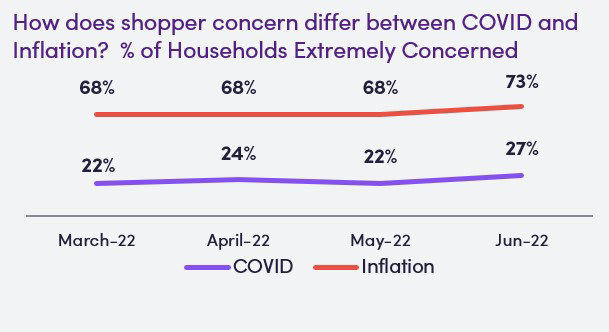

73% of consumers are extremely concerned when it comes to inflation. When asked how inflation and rising prices will continue to impact them in the next 6 months, 68% believe things will be much worse than they have been.

Almost 90% of consumers are changing their shopping behaviors this month due to inflation and rising prices, up from 88% last month.

27% of consumers show an extreme concern when it comes to COVID, the highest concern since February.

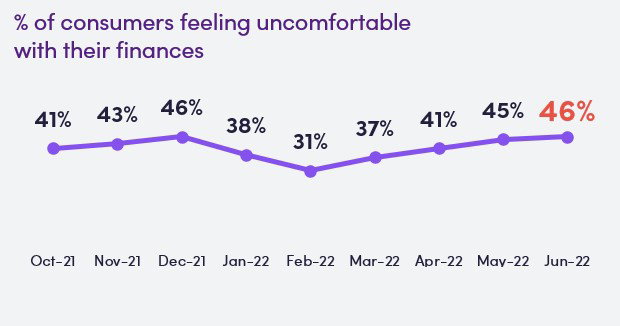

46% of consumers are feeling uncomfortable about their finances, comparable to the highest concern we saw back in December.

46% of consumers feel concerned when it comes to current supply chain issues.

Consumers continue to see rising prices across categories such as Dairy (83%), Deli/Meat/Fish counter (79%), Produce (74%), Frozen Food (68%), Paper Products (68%), Drinks (soft drinks, juices, etc.) (63%), Household cleaning (61%), and Canned Goods/Pastas/etc. (58%).

While 63% of consumers mention they have been looking for sales/deals/coupons more often as a result of higher priced items, 38% mentioned that it is much harder to find coupons/deals for the items they typically buy and 53% of consumers have noticed fewer items being on sale.

42% of consumers say they are purchasing fewer items on grocery trips. More specifically

57% say “I have been cutting back on non-essentials like snacks, candy, etc.”

39% say “I am purchasing more shelf stable items or items that won’t spoil or expire in a short period of time.”

33% say “I am buying less meat, fish.”

How is purchase behavior changing for these categories?

+1% increase in baskets containing candy vs. YA, but other snacks are in fewer baskets vs. YA.

+5% increase in baskets containing dry ramen, while other canned goods & pasta are consistent vs. YA.

-5% decrease in baskets containing chicken vs. YA, while other meat/fish declined as much as -20%.

59% of shoppers are purchasing less Health & Beauty Care products as a result of inflation, while 38% are purchasing the same amount, and 3% are purchasing more.

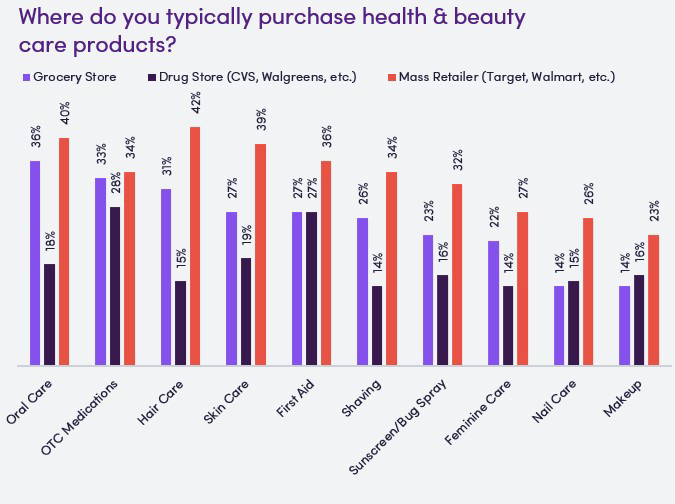

Oral Care, OTC Medications, and Hair Care are top Health & Beauty Care items purchased at Grocery Stores, with 36%, 33%, and 31% of shoppers buying these categories at Grocery Stores respectively.

For all Health & Beauty Care categories, Mass Retailers are the top destination where these items are typically bought.

Liquid & Bar Soap is in 15% fewer baskets overall and Deodorant is in 8% fewer baskets for price sensitive shoppers specifically.

The traditional holidays are tops for celebrations with 73% of shoppers planning to celebrate the 4th of July, followed by Labor Day at 47%.

62% of customers plan to gather with the same amount of people this summer vs. last summer, while 22% will gather with more people and 16% with less people.

81% of shoppers purchase Dairy ice cream, 9% purchase plant-based, and 9% do not buy ice cream.

72% of consumers buy ice cream at Grocery Stores, 35% at Mass Retailers, and 26% at an ice cream shop.

Subscribe to AC Group Insights

SOURCE: AC Group Real Time Insights, June 2022

See what you can learn from our latest posts.